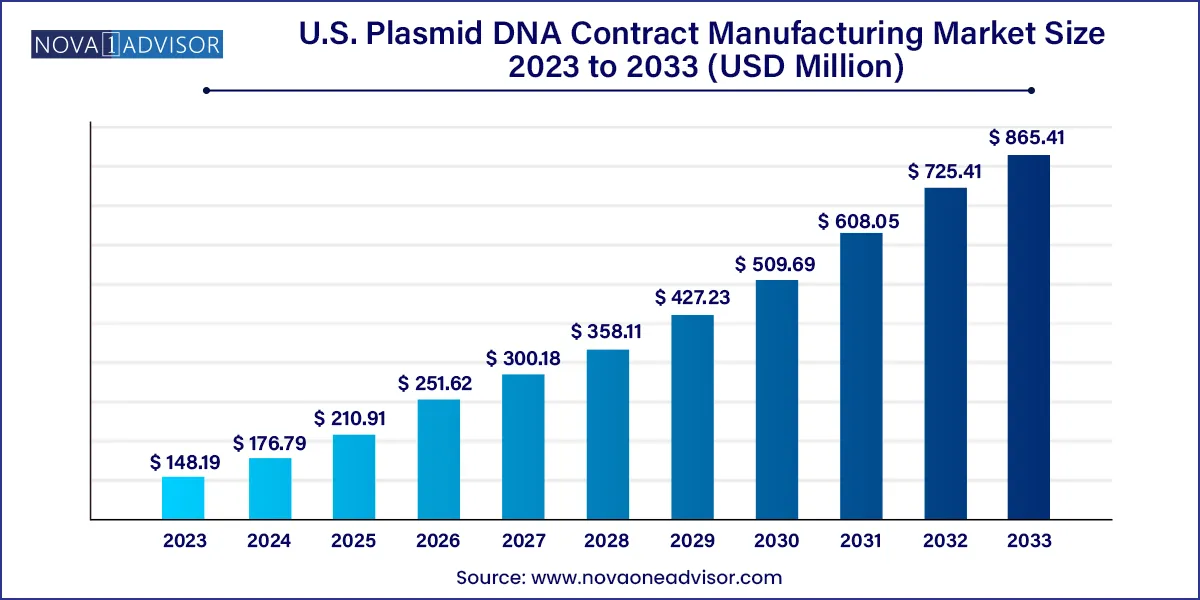

The U.S. plasmid DNA contract manufacturing market size was estimated at USD 148.19 million in 2023 and is projected to hit around USD 865.41 million by 2033, growing at a CAGR of 19.3% during the forecast period from 2024 to 2033.

Key Takeaways:

U.S. Plasmid DNA Contract Manufacturing Market Growth

The driving factors for market include the increasing popularity of cell and gene therapy for treating various diseases. Moreover, the increasing usage of gene therapy and mostly CAR-Ts has significantly escalated the demand for plasmid DNA, thus simultaneously supporting its contract manufacturing services.

Additionally, technological advancements to overcome the challenges of conventional methods for vector production are anticipated to support growth of this plasmid DNA contract manufacturing market. The field of gene therapy significantly broadens the treatment of viral infections, malignancies, hereditary illnesses, and immunotherapy. Hence, the growing adoption of gene therapy in the treatment of cancer is propelling the growth of U.S. plasmid DNA contract manufacturing market.

U.S. Plasmid DNA Contract Manufacturing Market Report Scope

| Report Attribute | Details |

| Market Size in 2024 | USD 176.79 million |

| Market Size by 2033 | USD 865.41 million |

| Growth Rate From 2024 to 2033 | CAGR of 19.3% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Applications, therapeutic area, end-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Aldevron; Charles River Laboratories; Akron Biotech VGXI, Inc.; Catalent, Inc.; DH Life Sciences, LLC; Recipharm AB; TriLink BioTechnologies; AGC BiologicsThermo Fisher; Scientific Inc. |

Segments Insights:

Application Insights

Based on application, cell and gene therapy segment held the largest market share with 60.9% in 2023 and is expected to dominate due to an increasing number of clinical trials and the subsequent increase in approved drugs. The market growth can be attributed to a growing dependability, efficiency, and safety of gene treatment in a wide range of chronic and genetic disorders.

Moreover, the active participation of CDMOs in developing new plasmid DNA boosts growth. For instance, in October 2022, Ray Therapeutics, along with Forge Biologics, a CDMO, extended their collaboration agreement for manufacturing of clinical-stage plasmid DNA to support Ray Therapeutics’ lead optogenetics gene therapy program.

The immunotherapy segment is projected to witness growth from 2024 to 2033. The growth is driven by rising R&D activities relevant to immunotherapy. As the prevalence of cancer is high, the adoption rates for novel immunotherapies for treating cancer are higher. For instance, as per the JAMA Oncology report published in 2023, about 11% and 27% adoption rates of immunotherapy have been adopted in rural clinical practice and urban clinical practice in the U.S. respectively. Such disease prevalence is likely to increase growth of this segment over the forecast years.

Therapeutic insights

Based on the therapeutic insights, cancer segment dominated this market with a share of 39.8% in 2023. The growth is highly driven by increasing prevalence of cancer and rising focus of key companies for cancer therapeutics. The growing adoption of cell & gene therapy for treating cancer is fueling the growth of U.S. Plasmid DNA contract manufacturing market. For instance, in October 2023, Charles River announced its partnership with Rznomics to manufacture viral vectors for gene therapy to treat patients with liver cancer.

The infectious segment is likely to grow at the fastest rate from 2024 to 2033. This growth is driven by rising commercialization of pDNA therapeutics for treating infectious diseases. For instance, in February 2023, GeneScript ProBio and RVAC joined together to manufacture COVID-10 Vaccine pDNA. This collaboration aims to help expedite the clinical manufacturing of RVM-V001 and future mRNA-based vaccines that target infectious diseases such as Clostriodioides difficile infection (CDI) and Respiratory syncytial virus (RSV).

End-use Insights

Based on the end-use, the pharmaceutical and biotechnology companies dominated this market with a share of 59.13% in 2023. This growth can be attributed to the increasing manufacturing of plasmid DNA-based therapeutics across the U.S. Moreover, key market companies are focusing on strategic initiatives to escalate pDNA production thereby boosting the growth of the segment. For instance, in January 2023, Charles River Laboratories International, Inc. announced the launch of the eXpDNA™ plasmid platform. This platform would help in reducing plasmid manufacturing and production timelines for gene therapy.

The research institutes segment is expected to witness the fastest growth from 2024 to 2033 due to increasing funding for cell & gene therapy-based research. Research institutes are significantly focusing on the R&D of cell and gene therapies due to the growing demand for plasmid DNA. Hence, the increasing funding coupled with the growing demand for plasmid DNA-based therapeutics will strongly escalate the segment’s growth in the plasmid DNA contract manufacturing market. For instance, in Septemeber 2019, the National Institutes of Health (NIH) revealed about 24 grants have been awarded to researchers across the United States through the Somatic Cell Genome Editing (SCGE) Program. This program was funded by the NIH Common Fund to improve genome-editing techniques and manufacturing of genome-editing therapies.

Recent Developments

Some of the prominent players in the U.S. Plasmid DNA Contract Manufacturing Market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Plasmid DNA Contract Manufacturing market.

By Application

By Therapeutic Area

By End-use

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Application

1.2.2. Therapeutic Area

1.2.3. End-use

1.2.4. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. nova one advisor’s internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.4.5.1. Data for primary interviews in Italy

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Application

2.2.2. Therapeutic Area

2.2.3. End-use

2.3. Competitive Insights

Chapter 3. Plasmid DNA Contract Manufacturing Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.3. Market Driver Analysis

3.3.1. Increasing disease prevalence

3.3.2. Growing Investments in Research Studies

3.3.3. Growing Popularity of Gene Therapy Introduction to technologically advanced healthcare services

3.4. Market Restraint Analysis

3.4.1. Lack of advanced infrastructure for manufacturing in certain developing countries

3.4.2. Quality Issues associated with Contract Manufacturing

3.4.3. U.S. Plasmid DNA Contract Manufacturing Market Analysis Tools

3.4.4. Industry Analysis - Porter’s Five Forces

3.4.4.1. Supplier power

3.4.4.2. Buyer power

3.4.4.3. Substitution threat

3.4.4.4. Threat of new entrant

3.4.4.5. Competitive rivalry

3.4.5. PESTEL Analysis

3.4.5.1. Political landscape

3.4.5.2. Technological landscape

3.4.5.3. Economic landscape

Chapter 4. U.S. Plasmid DNA Contract Manufacturing Market Application Estimates & Trend Analysis

4.1. U.S. Plasmid DNA Contract Manufacturing Market Application Dashboard

4.2. U.S. Plasmid DNA Contract Manufacturing Market Application Movement Analysis

4.3. U.S. Plasmid DNA Contract Manufacturing Market Size & Forecasts and Trend Analyses, 2018 to 2030

4.4. Plasmid DNA contract manufacturing (EHR) Market Estimates And Forecasts, 2021 - 2033

4.4.1. Gene Therapy

4.4.1.1. Gene Therapy Market Estimates And Forecasts, 2021 - 2033

4.4.2. Immunotherapy

4.4.2.1. Immunotherapy Market Estimates And Forecasts, 2021 - 2033

4.4.3. Others

4.4.3.1. Others Market Estimates And Forecasts, 2021 - 2033

Chapter 5. U.S. Pharmaceutical Market: Therapeutic Area Estimates & Trend Analysis

5.1. U.S. Plasmid DNA contract manufacturing Market Therapeutic Area Dashboard

5.2. U.S. Plasmid DNA Contract Manufacturing Market Therapeutic Area Movement Analysis

5.3. U.S. Plasmid DNA Contract Manufacturing Market Size & Forecasts and Trend Analyses, 2018 to 2030

5.4. Cancer

5.4.1. Cancer Market Estimates and Forecasts, 2021 - 2033

5.5. Infectious Disease

5.5.1. Infectious Disease Market Estimates and Forecasts, 2021 - 2033

5.6. Autoimmune Diseases

5.6.1. Autoimmune Diseases Market Estimates and Forecasts, 2021 - 2033

5.7. Market Estimates and Forecasts, 2021 - 2033

5.7.1. Cardiovascular Diseases Market Estimates and Forecasts, 2021 - 2033

5.8. Others

5.8.1. Others Market Estimates and Forecasts, 2021 - 2033

Chapter 6. Pharmaceutical Market: End-use Outlook Estimates & Trend Analysis

6.1. U.S. Plasmid DNA contract manufacturing End-use Model Dashboard

6.2. U.S. Plasmid DNA Contract Manufacturing Market End-use Movement Analysis

6.3. Pharmaceutical Market: Business Model Outlook Movement Analysis

6.3.1. Pharmaceutical and Biotechnology Companies

6.3.2. Pharmaceutical and Biotechnology Companies Market Estimates and Forecasts, 2021 - 2033

6.3.3. Research Institutes

6.3.4. Research Institutes Market Estimates and Forecasts, 2021 - 2033

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company/Competition Categorization

7.3. Vendor Landscape

7.3.1. List of key distributors and channel partners

7.3.2. Key customers

7.3.3. Key company market share analysis, 2023

7.3.4. Cerner Corporation

7.3.5. Aldevron

7.3.5.1. Company overview

7.3.5.2. Financial performance

7.3.5.3. Product benchmarking

7.3.5.4. Strategic initiatives

7.3.6. Charles River Laboratories

7.3.6.1. Company overview

7.3.6.2. Financial performance

7.3.6.3. Product benchmarking

7.3.6.4. Strategic initiatives

7.3.7. Akron Biotech

7.3.7.1. Company overview

7.3.7.2. Financial performance

7.3.7.3. Product benchmarking

7.3.7.4. Strategic initiatives

7.3.8. VGXI, Inc

7.3.8.1. Company overview

7.3.8.2. Financial performance

7.3.8.3. Product benchmarking

7.3.8.4. Strategic initiatives

7.3.9. Catalent, Inc

7.3.9.1. Company overview

7.3.9.2. Financial performance

7.3.9.3. Product benchmarking

7.3.9.4. Strategic initiatives

7.3.10. DH Life Sciences, LLC

7.3.10.1. Company overview

7.3.10.2. Financial performance

7.3.10.3. Product benchmarking

7.3.10.4. Strategic initiatives

7.3.11. Recipharm AB

7.3.11.1. Company overview

7.3.11.2. Financial performance

7.3.11.3. Product benchmarking

7.3.11.4. Strategic initiatives

7.3.12. TriLink BioTechnologies

7.3.12.1. Company overview

7.3.12.2. Financial performance

7.3.12.3. Product benchmarking

7.3.12.4. Strategic initiatives

7.3.13. AGC BiologicsL

7.3.13.1. Company overview

7.3.13.2. Financial performance

7.3.13.3. Product benchmarking

7.3.13.4. Strategic initiatives

7.3.14. Thermo Fisher

7.3.14.1. Company overview

7.3.14.2. Financial performance

7.3.14.3. Product benchmarking

7.3.14.4. Strategic initiatives

7.3.15. Scientific Inc.

7.3.15.1. Company overview

7.3.15.2. Financial performance

7.3.15.3. Product benchmarking

7.3.15.4. Strategic initiatives